ExxonMobil and its Canadian affiliates, Imperial and ExxonMobil Canada, have agreed for the sale of jointly owned XTO Energy Canada to Whitecap Resources Inc.

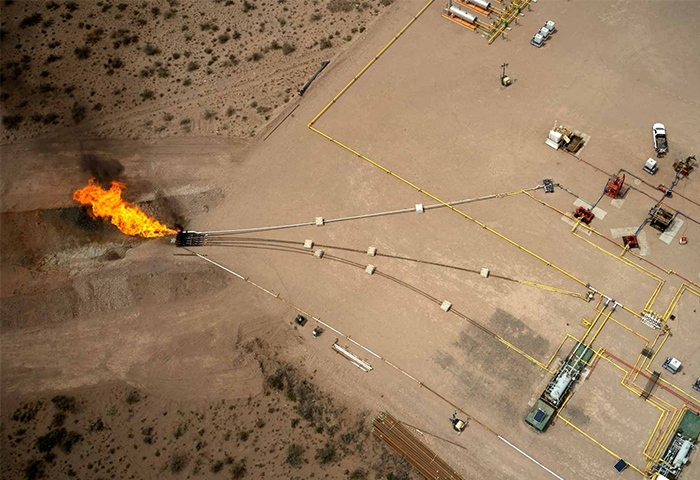

XTO Energy Canada ULC is a leading natural gas and oil producer in Western Canada with expertise in developing tight gas, shale gas, coal bed methane and unconventional oil resources.

The sale, for a total cash consideration of about $1.47 billion, is expected to close before the end of the third quarter, subject to regulatory approvals.

The sale completes the marketing effort announced in January, and is consistent with ExxonMobil’s strategy to focus upstream resources on key assets to deliver long-term value to shareholders.

The assets include 567,000 net acres in the Montney shale, 72,000 net acres in the Duvernay shale and additional acreage in other areas of Alberta. Net production from these assets is about 140 million cubic feet of natural gas per day and about 9,000 barrels per day of crude, condensate and natural gas liquids.

The deal increases Whitecap's total acreage in the Montney by over 500% and adds 1,772 (1,693 net) Montney drilling locations. The deal also consolidates certain working interests at Kakwa, Alta., to 100% from an average of 66% on about 22,000 gross acres, as per Whitecap statement.

RBC Capital Markets acted as exclusive financial advisor to Imperial and ExxonMobil Canada in connection with the transaction.

National Bank Financial Inc. is acting as financial advisor to Whitecap on the Acquisition. National Bank Financial Markets and TD Securities are acting as joint bookrunners and co-lead arrangers with respect to the term loan facilities.

Also read: bp Shifts Focus From Oil Sands To Offshore Growth In Canada