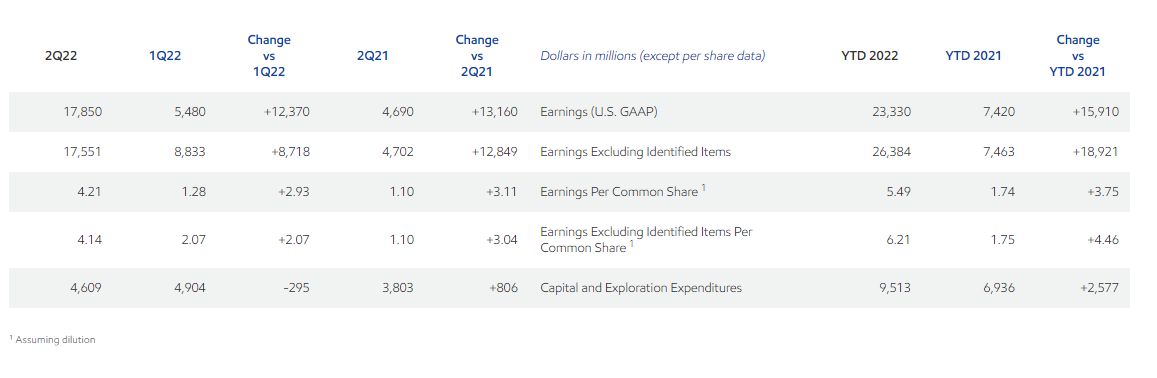

Exxon Mobil Corp. reported its second-quarter profit of $17.9 billion compared with $5.5 billion in the first quarter of 2022, driven by a tight supply/demand balance for oil, natural gas and refined products. The benchmark Brent crude oil futures averaged around $114 a barrel in the quarter.

The company said its profit jumped to $4.21 per share compared from $4.69 billion, or $1.10 a share in the same period last year. The oil and natural gas company posted a revenue of $115.68 billion in the period.

Second-quarter results included a favorable identified item of nearly $300 million associated with the sale of the Barnett Shale Upstream assets.

Commenting on the results, Darren Woods, Chairman and Chief Executive Officer, said, “Key to our success is continued investment in our advantaged portfolio, including Guyana, the Permian, global LNG, and in our high-value performance products, along with efforts to reduce structural costs and improve efficiency. We're also helping meet increased demand by expanding our refining capacity by about 250,000 barrels per day in the first quarter of 2023 - representing the industry's largest single capacity addition in the US since 2012."

Capital and exploration expenditures were $4.6 billion in the second quarter and $9.5 billion for the first half of 2022.

Cash increased by $7.8 billion in the second quarter, as strong cash flow from operating activities more than covered capital investments and shareholder distributions. Free cash flow in the quarter totaled $16.9 billion. Shareholder distributions were $7.6 billion for the quarter, including $3.7 billion of dividends.

Results Summary

Source: Exxon

Exxon increased Permian oil and gas production by approximately 130,000 oil-equivalent barrels per day and refining throughput by 180,000 barrels per day, versus the first half of 2021, to meet recovering product demand.

Effective April 1, to improve the effectiveness of operations and to better serve customers, the Corporation formed ExxonMobil Product Solutions, combining world-scale Downstream and Chemical businesses. The company also centralized Technology & Engineering and Operations & Sustainability groups to further capture the benefits of technology, scale and integration.

Due to historically high inflation Americans are forced to spend more on gas and bills and the financial pressures have started to bite low-income consumers. Governments in UK and US have been pressurizing the big oil giants to invest their profits to benefit their country’s economy.