Oil prices are soaring by the day and the need for reducing carbon emissions has been critical for reversing the adverse impact that it has on climate change. Vehicle owners are looking for an alternative mode of transport for their daily commute in a bid to save money spent on filling up their car tanks and the public transport is already teeming with commuters. In all of these ongoings, electric vehicles (EVs) have been the latest entry into the decarbonization and energy-efficiency agenda. Stocks of companies, like Tesla, which manufactures EVs, have been enjoying high rankings in the automobile market. In the UAE, the latest entry is the Swedish electric vehicle brand, Polestar, owned by Volvo. The promoters of the car hope that its introduction will align with the government’s strategic target of Net Zero emissions by 2050. Polestar vehicles are currently available and on the road in markets across Europe, North America, China, and Asia Pacific. By 2023, the company plans that its cars will be available in an aggregate of 30 markets.

Conversely, to support the transition of the UAE and Abu Dhabi to achieving carbon neutrality within the next three decades and in anticipation of the growth in demand for electric cars, the Abu Dhabi Department of Energy has released the regulatory policy for EV charging infrastructure in the emirate. The policy sets out the stipulations and criteria for establishing a network of EV charging stations across the UAE capital. The principles also include ownership, installation, and management of Electric Vehicle Supply Equipment (EVSE), the electricity supply to EVSE, and the pricing mechanism to end customers.

EVs are being seen as the best option for transitioning the transportation sector towards electricity and away from fossil fuels with globally proven economic and environmental benefits.

However, the production of EVs could face challenges as a result of supply chain disruptions and scarcity of the raw materials that go into making them.

Tesla chief Elon Musk recently announced that the EV carmaker would fall short of its target of delivering 20 million battery-powered cars a year by the end of the decade. He has cited the raw material constraints in lithium and cathode production in the coming years as the major reasons. Other EV industry leaders have concurred with Elon’s view.

Why is lithium scarce?

According to a report published by the Cobalt Institute, EVs surpassed smartphones and other high-tech devices for the first time in 2021 as the main driver of cobalt demand, with the sector consuming 59,000 tonnes of battery metal, or 34% of the total globally. Cellphone manufacturers consumed 26,000 tonnes of the metal used in lithium-ion batteries, while laptops and tablets accounted for 16,000 tonnes of the total demand, which reached 175,000 tonnes. In contrast, 160,000 tonnes of cobalt were mined in 2021. One of the biggest challenges for EV manufacturers has been the lack of battery metals. Since the beginning of last year, prices for cobalt, nickel, lithium, and copper have skyrocketed. Cobalt price nearly tripled in price and Nickel’s trading had to be suspended on the London Metal Exchange (LME) as a result of its high price. To compensate for cobalt and nickle use, battery-makers are using lithium-iron-phosphate chemistry minus cobalt or nickel, which has resulted in higher demand for lithium, pushing prices up almost 500% in one year. The spot price of lithium carbonate, a compound that converts to lithium, rose b 477% in 2021 and further 77% in this year. Benchmark Mineral Intelligence estimates the global lithium industry needs as much as $42 billion of investment by the end of the decade to meet demand. The scarcity of lithium and other raw materials will drop battery production, offsetting the global strategy to expand clean-energy vehicles as catalysts to reduce carbon emissions to achieve the climate change targets.

Why do EVs still stand a chance?

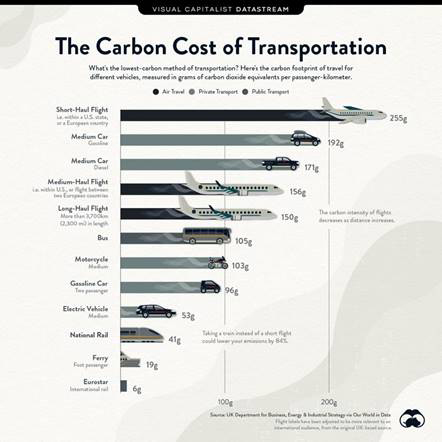

Projections show the magnitude of GHG reductions needed in transport is about 40% from 2020 to 2030 and 80% from 2020 to 2050, just considering the emissions from the combustion and production of fuels and electricity. With the expected increase in transportation demand in the coming decades, emissions reductions per vehicle will need to be even larger.

Electric vehicles are nearly always lower-carbon than petrol or diesel cars, especially in a country that produces much of its electricity by renewables or nuclear.

As per IEA, there are currently over 10 million electric cars on the road, representing 1% of the global car stock. For 2030, the Net Zero Emissions by 2050 Scenario projects 300 million electric cars on the road and they account for over 60% of new car sales, compared with only 4.6% in 2020.

To keep pace with the carbon neutrality goals, governments should facilitate the scaling up of battery manufacturing by creating a policy framework that reduces investment risks, for instance, by providing clear signals on the deployment of charging infrastructure, fuel economy standards, and zero-emission mandates.

Collaboration with key industry participants to understand how to scale up capacity and investments can aid the establishment of domestic automotive battery production value chains. Governments should also create policy frameworks that assign value to the sustainability of batteries over their lifecycle, to ensure that all stakeholders have an interest in developing the battery value chain with the smallest possible environmental footprint.

In terms of battery recycling, policies can be pivotal in preparing countries for exponential growth in EV and storage battery waste. Clear guidance on collecting, transporting, and storing end-of-lifetime lithium-ion batteries is crucial, the IEA has pointed out.