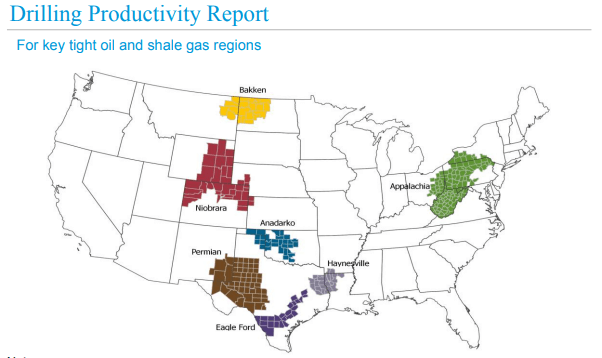

The US Energy Information Administration (EIA) in its August Drilling Productivity Report shows that oil production in the Permian Basin in Texas and New Mexico – the largest US shale oil basin – will increase 79,000 barrels per day (bpd) month over month to reach 5.408 million bpd in September. This is the highest since March 2020 (71,000 barrels bpd to reach 5.205 million bpd).

The report shows the total output in the major US shale oil basins to rise 141,000 bpd to 9.049 million bpd in September.

The EIA forecasts oil output to rise 21,000 bpd to 1.157 million bpd in September in the Bakken Basin in North Dakota and Montana. Output in the Eagle Ford Basin in South Texas will rise 26,000 bpd to 1.230 million bpd in September.

Total natural gas output in the big shale basins will increase 0.673 billion cubic feet per day (bcfd) to a record 93.835 bcfd in September, the EIA also forecasts.

In the biggest shale gas basin in Appalachia, Pennsylvania, Ohio and West Virginia, output will rise to 35.486 bcfd in September. In December 2021, it touched the highest record to date – close to 36.0 bcfd.

Meanwhile, gas output in the Permian, as well as the Haynesville Basins across Texas, Louisiana and Arkansas will also rise to record highs of 20.584 bcfd and 15.835 bcfd, respectively, in September, the report shows.

The Permian Basin is known to be the most active US oilfield, producing over 5 million barrels of oil per day – almost half of the total US output of 11 million bpd, per data from the EIA. In 2019, the Permian Basin became the most productive oil region in the world overtaking Saudi Arabia’s Ghawar field as the largest oil producing region. The companies extracting oil in the Permian Basin use the controversial fracking technology for the operations.

Source: EIA

Meanwhile, oil prices fell, continuing their losses after passive economic data from China reflected the likelihood of a global recession and continued Covid restrictions. In addition, the release of US data showing dwindling factory activity in August has raised worries of disruption in energy demand.

At the time of this writing, Brent crude stood at $94.16 a barrel, and WTI was at $88.89 a barrel.

Meanwhile, the market carries anticipation for the revival of the 2015 Iran nuclear deal between Iran and the United States, the resumption of which would lift oil sanctions on Iranian exports and increase supply accordingly.

Related: US LNG Exports Were World’s Highest in H12022

Related: OPEC+ Agrees to 100,000 bpd Oil Production Increase for September