Currently, there are two seemingly conflicting opinions playing out in the energy sector – the push for renewable sources versus the need to end fossil fuels use at the earliest. While climate activists are pressing for decarbonization across industries, energy market players say that more investments are needed in exploring hydrocarbons until a solution is found that will satisfy the world’s energy requirements. Moreover, this global situation has been accentuated by the evolving Russia-Ukraine conflict that has seen a major energy crisis develop in Europe, fueling an inflationary environment that engulfs most parts of the globe. European natural gas prices and Asian spot LNG prices touched record highs in the third quarter of 2022, resulting in the reduction of gas demand and prompting the use of other fuels such as coal and oil for power generation. In some emerging and developing economies, the high prices created shortages and power cuts. Europe’s gas consumption declined by more than 10% in the first eight months of this year compared with the same period in 2021, driven by a 15% drop in the industrial sector, as factories curtailed production.

The world needs energy in any shape or form to drive its economic growth. It doesn’t care if it comes from renewable sources or traditional sources such as coal and hydrocarbons, as long as the trade routes are operating and the factories are electrified. However, there is also a responsibility to care for our planet’s sustainability; otherwise, the whole idea of economic growth would lose its very meaning and purpose. The concept of the energy transition is a welcome proposition, but the variables have to dovetail with the overall interest in human existence.

Energy Has a Price

Major energy companies reaped huge profits as economic activities picked up globally after the COVID pandemic restrictions were eased, notably during 2021–2022. Governments have proposed a “windfall tax” on these companies so that they can invest in alternative energy sources other than fossil fuels as well as other economic developments. UN Secretary-General António Guterres, during his recent General Assembly speech, said that energy giants were “feasting on hundreds of billions of dollars in subsidies and windfall profits while household budgets shrink and our planet burns.” Although the energy companies acknowledge the need for decarbonization, especially when it comes to the use of coal, the energy transition approach has not gone well with most of them. The industry maintains that imposing a tax on energy companies will erode investors’ interest and impact energy production, resulting in less investment in renewables. Underscoring the industry sentiment, Michael Wirth, chairman of the board and CEO of Chevron Corporation, has accused the Western governments of exacerbating the energy crunch situation as a result of the excessive push to renewables. Speaking to an international business magazine, Wirth said that the lopsided view on climate change was taking affordability and security (of energy) for granted. “The reality is, (fossil fuel) is what runs the world today. It’s going to run the world tomorrow and five years from now, 10 years from now, 20 years from now,” he stressed.

Furthermore, speaking at the Energy Intelligence Forum in London, H.E. Dr. Sultan Ahmed Al Jaber, UAE minister of industry and advanced technology and managing director and group CEO of Abu Dhabi National Oil Company (ADNOC), said that “the policies aimed at pulling the plug on the current energy system before we have built the new one are misguided.” As a strong proponent, Al Jaber said that for economic progress to be maintained, substantial investment is required in hydrocarbons – the energy source the world will rely on well into the future. “Yes, we must all commit to mitigating the impact of global energy supplies, but let’s keep our focus on capturing carbon, not canceling production. Let’s hold back emissions, not progress,” reasoned Al Jaber.

Another twist in the tale worthy of global consideration is the issue of the supply and demand of oil. At a recent meeting, OPEC+ agreed to cut oil production by 2 million barrels per day amidst a growing global energy crisis. This decision of the oil producers’ group has sparked a flurry of debates to the point that they have been accused of siding with Russia to aid its war against Ukraine. Terms such as “weaponization of energy” and “geopolitical coercion” seem to be popping up in the headlines on energy news. As such, a strong sense of manipulative forces controlling the global situation seems to abound. OPEC+ maintains that its decision to cut production is purely an economic one and is motivated by the need to insulate itself given the evolving risk of a global recession. Consequently, the recent drop in oil prices from over $100 a barrel in August to around $91 today seems to support the OPEC+ decision. At the end of the day, oil producers are here for profit, not charity. To this end, OPEC+'s primary mandate is the stabilization of the oil market, and they have to stick to any measures that will ensure that goal. Failing to do so could lead to unforeseen and unpleasant territory.

Fossil Fuels vs. Renewables

To give an idea of the equation of fossil fuels as compared to renewables in a global context, bp’s Statistical Review of World Energy for 2021 shows that fossil fuels accounted for 82% of primary energy use in 2021, albeit down from 83% in 2019 and 85% five years ago. The report further notes that coal consumption grew over 6% in 2021 to 160 exajoules (EJ), slightly above 2019 levels and its highest level since 2014. China and India accounted for over 70% of the growth in coal demand in 2021, increasing by 3.7 and 2.7 EJ, respectively. Even Europe and North America showed an uptake in coal consumption in 2021 after nearly 10 years of successive declines.

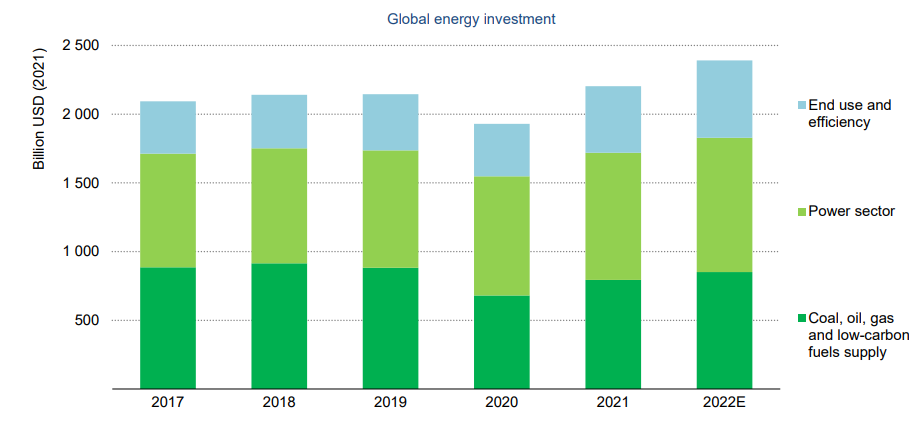

Conversely, renewable primary energy (including biofuels but excluding hydro) increased by around 5.1 EJ in 2021, reflecting a yearly growth rate of 15% compared to 9% a year earlier and higher than that of any other fuel in 2021. Solar and wind capacity continued to grow rapidly in 2021, increasing by 226 GW, close to the record increase of 236 GW seen in 2020. According to IEA’s World Energy Investment 2022 report, energy investment is set to increase by 8% in 2022 against the backdrop of the global energy crisis, but almost half of the increase in capital spending is linked to higher costs.

Source: IEA

bp’s review corresponds with the International Energy Agency’s (IEA) new analysis, which notes that CO2 emissions are set to increase by nearly 300 million tonnes in 2022, to 33.8 billion tonnes – a big drop from the nearly 2 billion tonne increase in 2021, which resulted from the rapid global post-COVID economic recovery. This year’s increase is driven by power generation and by the aviation sector, as air travel rebounds from pandemic lows.

The positive trend in the growth of renewables has been heartily acknowledged by industry leaders.

“This means that CO2 emissions are growing far less quickly this year than some people feared – and that policy actions by governments are driving real structural changes in the energy economy. Those changes are set to accelerate thanks to the major clean energy policy plans that have advanced around the world in recent months,” notes IEA Executive Director Fatih Birol.

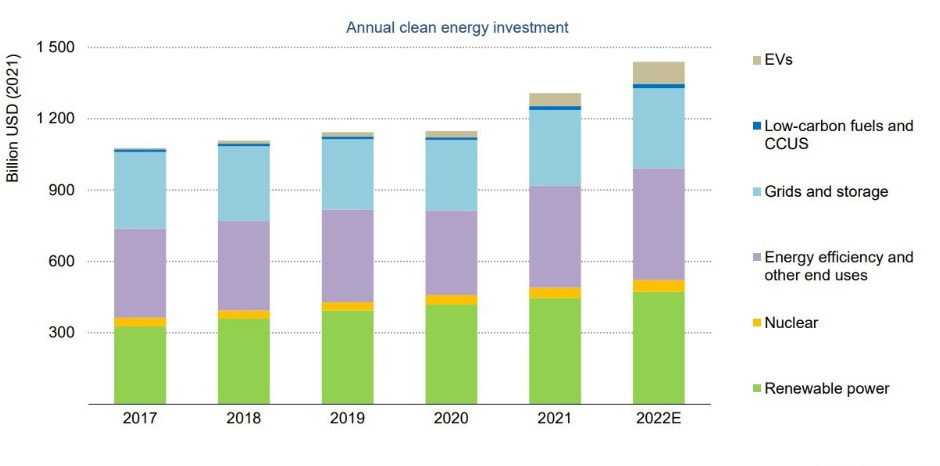

In compliance with governments’ green policies, major energy companies have already initiated their environmental, social and governance (ESG) strategies. For instance, bp acquired US-based renewable natural gas (RNG) producer Archaea Energy Inc. for about $4.1 billion in a strategic move to expand its alternative fuels business. Following this trend are many major regional and global companies, such as ADNOC, Saudi Aramco, Eni and Shell to name a few. Most of these companies have aggressively adopted digital technologies to drive the transition to a net-zero emissions future, reducing the carbon footprint of their operations and offering low-carbon energy solutions to their customers while further enabling the next generation of clean energy technology. The share of spending by oil and gas companies on clean energy is rising slowly, with progress being driven mainly by the European majors and a few other companies. Overall, clean energy investment accounts for around 5% of oil and gas company capital expenditure worldwide, up from 1% in 2019. Also read: Gap in Global Collaboration Can Delay Green Transition by Decades, Notes IEA

Source: IEA

Walking a Tightrope

However, the stark reality is that fossil fuels are needed to meet the growing demands on the electric grid even as we add renewables. As we all know, renewable energy is largely dependent on natural elements, which can be unpredictable, to say the least. According to the IEA, solar PV and wind power are leading an increase in global renewable electricity generation in 2022 with more than 700 terawatt-hours (TWh), the largest annual rise on record. Without this increase, global CO2 emissions would exceed 600 million tonnes this year. The rapid deployment of solar and wind is expected to account for two-thirds of the growth in renewable power generation. Hydropower production has faced limitations due to the dry seasons in some regions; however, global hydropower output is up year-on-year, contributing over one-fifth of the expected growth in renewable power. On the other hand, nuclear energy, despite making a comeback as a low-carbon power source in the energy mix, has faced headwinds in its optimal capacity. According to the annual World Nuclear Industry Status Report (WNISR), the share of nuclear power in global gross electricity generation fell below 10% in 2021, its lowest point in four decades. End-of-life nuclear plants and the hefty cost of reactors compared to renewables have been detrimental to their rapid development and implementation. As of mid-2022, 411 reactors were operating in 33 countries, four fewer than in 2021 and 27 below a 2002 peak of 438. Of the 53 reactor projects currently under construction, at least half are being delayed. Five new units became operational in the first half of 2022, while eight closed last year. The limitations of renewables and other alternative sources such as nuclear energy cannot be overlooked, as continuous and stable power generation is a prerequisite for driving our modern economies.

By contrast, fossil fuels come with their own unique properties of energy density as well as an ability to provide exceptionally high heat. Greater energy density means that a smaller weight or volume of fuel is needed to deliver the goods. Moreover, although non-renewable, oil sources are believed to be in abundance, and the advancement in the technology to extract them is becoming more sophisticated by the day, making it economically viable to continue to produce and use such fuels, including natural gas.

However, we all know that the advantages of fossil fuels come with a price. The CO2 released from the burning of fossil fuels continues to heat our planet and set geological records. Climate change has become the most pressing challenge facing humanity today, and limiting the global temperature to 1.5 degrees Celsius will likely determine the future of humanity.

Easing Transition

As alluded to earlier, stagnation of the world’s economy is a poor strategy to deal with climate change. Just as it is important that we save our planet, it is equally important to ensure that the world does not go into a global recession. Despite this polarization over renewables and fossil fuels, renewed investments in new oil exploration have been going on in many parts of the world. As an aside, some analysts fear any remaining lack of demand is a result of “peak oil” – the hypothetical point in time when the maximum rate of global oil production will begin an inevitable decline, leaving backlogs of “stranded assets.”

According to Preqin, a London-based investment data company, private capital funds’ worldwide investments in fossil fuels — oil and natural gas — have garnered $27.9 billion in 2022, compared with a total of $19.4 billion in all of 2021. This trend can either derail the progress toward a clean-energy transition or be advantageous if the return on those investments is used on technologies that could, in turn, accelerate the ultimate transition to clean energy.

A prime example of the latter trend is the Middle East, which is slowly shifting to green energy and sustainable solutions to both combat global warming and diversify its energy sources (despite its status as a leading oil-producing region). The UAE, in particular, aims to achieve net-zero emissions by 2050 through the UAE Net-Zero by 2050 Strategic Initiative. More than 15 years ago, the UAE began financing clean energy projects and has invested over $40 billion in the sector to date. Current trends predict clean energy production capacity, including solar and nuclear, to reach 14 GW by 2030, up from about 100 MW in 2015 and 2.4 GW in 2020. Also read: COP27: UAE, Egypt Agree to Build Grand-Scale Wind Farms

In advancing this positive trajectory, the United Nations’ COP 27 Climate Change Conference in Sharm El-Sheikh, Egypt – and next year’s COP 28 in the UAE – must further ensure that practical solutions for energy transition are envisioned and established that will adequately address the environmental concerns of the world’s population – concerns that have been at the mercy of volatile economic conditions for far too long.

Also read: Geopolitics: catalyst for renewable energy acceleration