It is no secret that electricity prices in Europe have soared due to a combination of factors, most prominently Russia's war in Ukraine and the curtailing of natural gas supplies. But how bad is it going to get this winter? Will the continent have enough energy to power homes and factories? Or will industrial operations have to shut down?

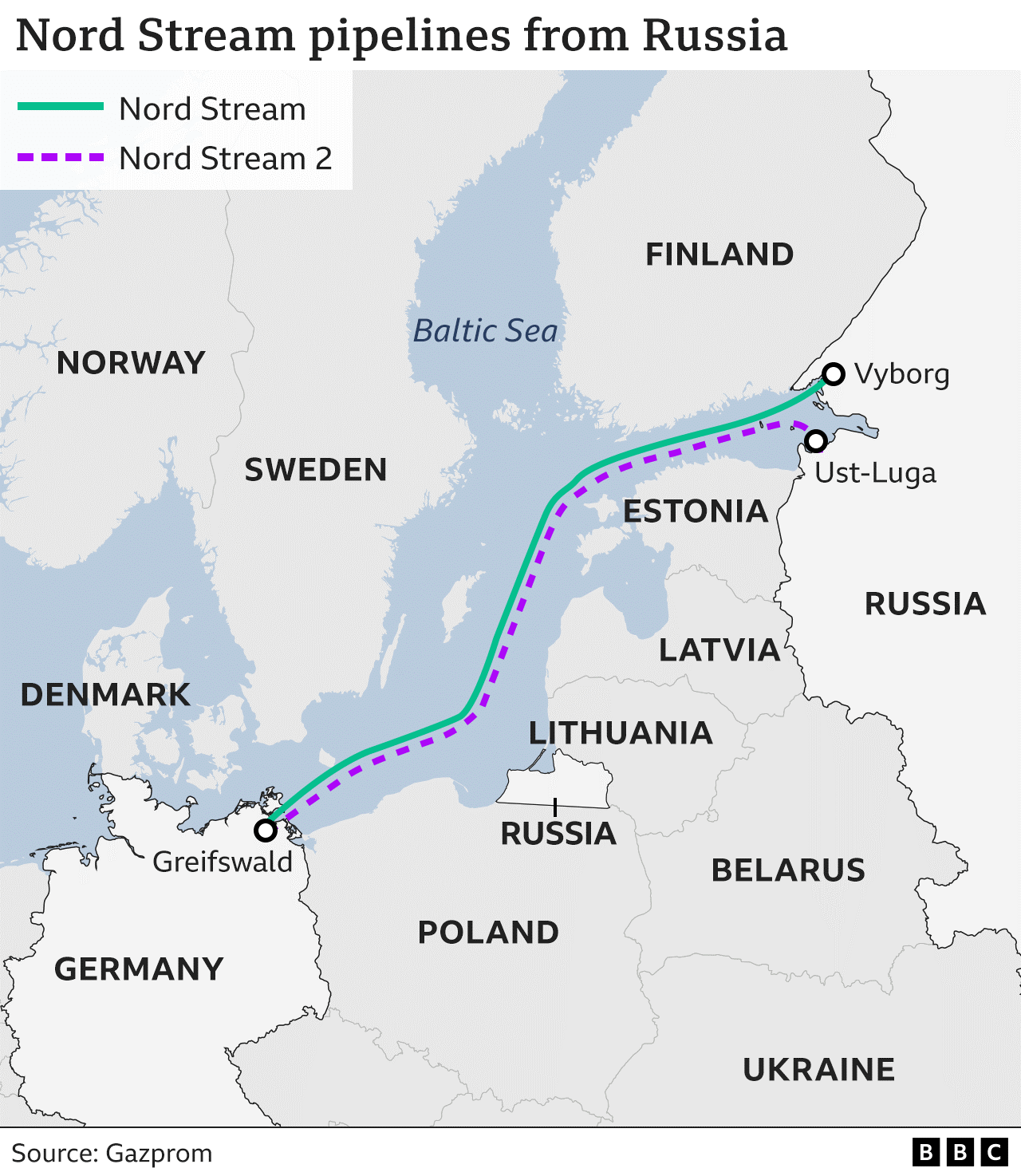

Russia, Europe’s largest natural gas supplier, providing about 34% of the gas used in Europe, has been cutting flows to Germany through the Nord Stream 1 pipeline, with it now operating at less than a fifth of its normal capacity.

Before the Ukraine War, Germany imported over half of its gas from Russia, and most of it came through Nord Stream 1 – with the rest coming from land-based pipelines. By the end of June, that had been reduced to just over a quarter.

The UK has not been directly impacted by gas supply disruption, as it imports less than 5% of its gas from Russia. However, it has been affected by rising prices in the global markets, as demand in Europe continues to increase.

European wholesale gas prices closed at €204.85 (£172.08) per megawatt hour – the third highest price on record. The all-time high was achieved on March 8 when prices closed at €210.50 (£176.76) per megawatt hour, according to ICIS analytics.

By contrast, this time last year, the wholesale gas price in Europe was just above €37 (£31.08) per megawatt hour.

The latest reduction in flows puts pressure on EU countries to reduce their dependence on Russian gas even further, and will likely make it more difficult for them to replenish their gas supplies ahead of winter.

Since the invasion of Ukraine, European leaders have held talks over how to reduce their dependence on Russian fossil fuels.

The EU energy ministers’ recent political agreement on natural gas was touted as an example of European unity and solidarity. But while it might be a show of political unity, there was very little substance on display.

The essence of the agreement is a “voluntary reduction of natural gas demand by 15% for this winter.” Moreover, it is left totally up to member states to decide how to achieve this. It is nothing more than pure gesticulation politics. The European Commission wanted to obtain the power to make the reduction mandatory and to declare an EU-wide gas emergency, but this was unacceptable to member states. Unfortunately, the agreement does not mention how the target reduction in gas consumption should be achieved. The Commission’s factsheet “A European Gas Demand Reduction Plan” lists only measures such as “national public awareness campaigns” or mandatory temperature reductions in public buildings.

Thierry Breton, commissioner for the internal market of the European Union, wrote “The 3 ‘S’” to prepare for a winter without Russian gas” which are based on a strong triptych: Substitution, Solidarity and Sobriety. He details them as follows:

Optimized Substitution Efforts

The first step is to decouple our energy needs from Russia. It is essential to do everything now to find alternatives to Russian gas, for electricity production, for heating, for industry, etc.

This started with the diversification of natural gas supplies.

In the first half of 2022, non-Russian LNG imports increased by 21 bcm compared to the same period last year.

Non-Russian pipeline imports increased by 14 bcm from Norway, the Caspian Sea, the UK and North Africa.

And the Commission has multiple new partnerships, the latest signed by its President, von der Leyen, with Azerbaijan. But substitution also means deploying additional capacity beyond gas: to green energy wherever possible; to other energy sources where necessary.

Solar and wind power could amount to almost 6 billion m3 this year. But the speed of deploying renewable energy projects, which must be accelerated, risks not being sufficient in the potential event of rationing, i.e. plant closures and short-term work measures.

Other options need to be considered.

Some member states have already taken action in the electricity sector, with the use of coal-fired power stations or the extension of nuclear power plants.

There is also potential in the industry sector, estimated at almost 10% of annual gas consumption, or almost 4 billion m3.

For example, in the cement industry, it is possible to use the gases produced during refining as gas for fuel or to increase the energy efficiency of industrial steel-making processes by using oxyfuel.

It is therefore important to maximize this diversification potential now.

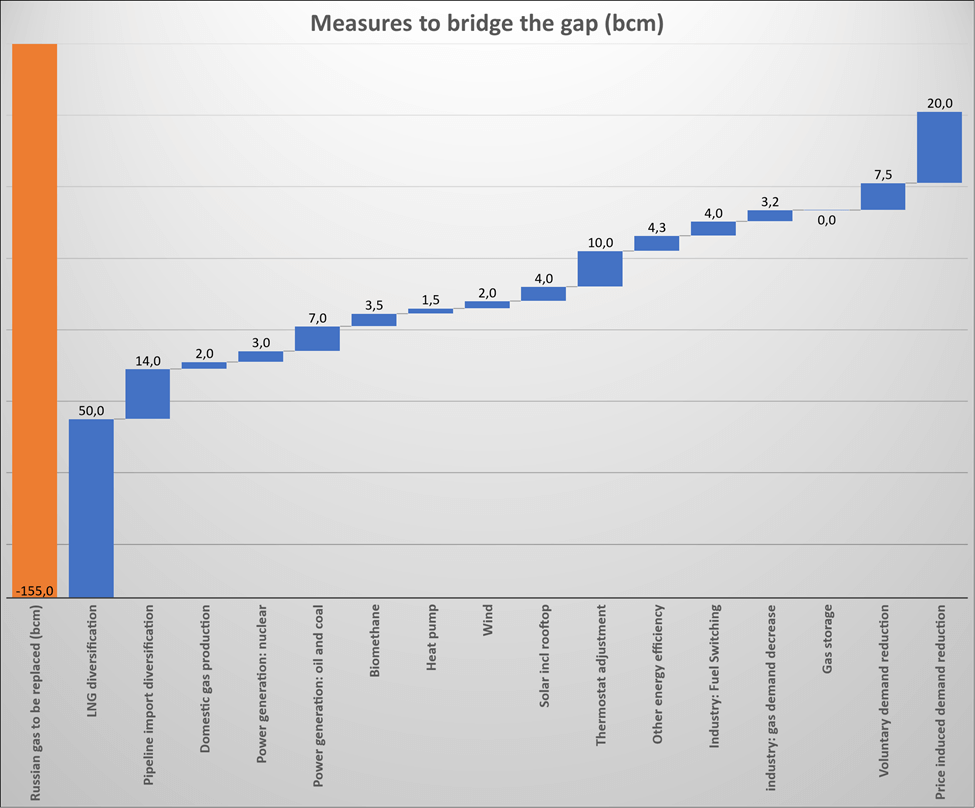

Below is a scoreboard on how Europe can do without Russian gas as early as this year. It does not include the role of gas stockpiles, which will be there to give us the necessary safety cushion if needed.

This data will help Europe to monitor progress in the coming months and to make adjustments where necessary.

Smart Solidarity Mechanisms

Of course, to get through winter, we need solidarity.

If we have learned anything from the early weeks of the COVID-19 pandemic, it is the importance of avoiding unilateral decisions by member states, which weaken our single market and increase the costs of the crisis, rather than cushion it. For this solidarity to work, however, each member state must take responsibility.

Member states asking for solidarity must demonstrate that they have implemented all the necessary measures to reduce Russian gas demand.

This solidarity must be thought out and deployed at a European level, whether by accelerating our joint purchases of gas today and hydrogen tomorrow or by coordinating our crisis management tools.

“But this requires a strong governance structure, because we cannot afford to let Member States pass the buck on this or that decision,” says Breton.

In this respect, the Commission's proposal requires that each member state demonstrates that it has made its "best efforts". And there will be an opportunity for discussion at the European level, in collegiality and coordination.

In addition, Europe will involve not only the energy industry but also industry specialists of the member states in the discussions.

Orderly Energy Savings

In the spring, the European Commission identified a potential energy savings of around 15 billion m3. The markets themselves have led to adjustments, as gas demand has already fallen by more than 8% – in industry in particular.

But we can undoubtedly do better by mobilizing collective awareness around this common objective.

Simple measures, such as lowering the temperature or better maintenance of our boilers, can already result in significant energy savings.

Additional incentive mechanisms, such as favorable tariff conditions in exchange for reduced consumption at peak times, can also be offered by energy suppliers.

In this context, the Commission provided clear guidelines to member states for preparing their contingency plans.

It clarified how to treat industrial sectors while avoiding too heterogeneous approaches between member states, which risks damaging our supply chains and disrupting our single market function.

Thus, the Commission has identified four main criteria to be taken into account:

1. Societal criticality: certain key sectors or products are essential to the functioning of society;

2. Cross-border supply chains: a dimension that needs to be factored into member states' contingency plans;

3. Potential damage to industrial facilities;

4. Possibilities for adjustments of gas consumption: some sectors have less flexibility in their gas management.

In a nutshell, again, Europe must do everything in its power to prevent the worst-case scenario – without hesitations or constraints, but with a sense of responsibility – to manage the crisis and to prepare for a common future.

Geneva in the Balance

Switzerland, like much of Europe, depends on outside energy sources in troubling times as the world grapples with how to fuel its homes, businesses, and industries.

Although it maintains its neutrality and is not part of the European Union, Russia's war on Ukraine and its subsequent impact on energy have the Swiss worried about the heating of their homes in the coming winter.

In this context, there are calls for the Alpine country to align more with its European neighbors.

Swiss Energy Minister Simonetta Sommaruga said recently that Switzerland should align with an EU plan for cutting energy consumption to cope with the fallout from the war in Ukraine.

Warning For a Difficult Winter

If Russia’s prolonged disruptions continue, experts warn of a particularly difficult winter, one of potential rationing, industrial shutdowns and even massive economic dislocation. British officials, who just a few months ago warned of soaring power bills for consumers, are now warning of even worse.

Unrest has already been brewing, with strikes erupting across the continent as households struggle under the pressures of the spiraling cost of living and inflationary pressures. Some of this discontent has also had knock-on effects in the energy market. In Norway, the European Union’s biggest supplier of natural gas after Russia, mass strikes in the oil and gas industries forced companies to shutter production, sending further shockwaves throughout Europe.

The pain of the crisis, however, is perhaps being felt most clearly in Germany, which has been forced to turn to a number of energy-saving measures, including rationing heated water and closing swimming pools. To cope with the crunch, Berlin has already entered the second phase of its three-stage emergency gas plan; last week, it also moved to subsidize its energy giants that have been financially debilitated by Russian cutoffs.

But it’s not just Germany. “This is happening all across Europe,” said Olga Khakova, an expert on European energy security at the Atlantic Council, who noted that France has also announced plans to nationalize the EDF power company as it buckles under mounting economic losses. “The challenging part is how much can these governments provide in support to their energy consumers, to these companies? And what is that breaking point?”

Can Europe Remain True to Its Climate Agenda Despite Russia’s War in Ukraine?

Russia’s attack on Ukraine and the consequent reduction in energy supplies to Europe has also complicated many of those countries’ climate goals and green transitions. In late June, Germany, Italy, Austria and the Netherlands announced they would restart old coal power plants as they grapple with shrinking energy supplies.

Some observers argue that a cold-turkey withdrawal from Russian fossil fuels will speed up the transition to renewable energy, but others predict that climate goals will fall by the wayside as European leaders turn to coal and whatever else is available to make up for the lack of Russian oil and gas.

The European Commission has today presented the REPowerEU Plan, its response to the hardships and global energy market disruption caused by Russia's invasion of Ukraine. There is a double urgency to transform Europe's energy system, including ending the EU's dependence on Russian fossil fuels.

The measures in the REPowerEU Plan can respond to this ambition, through energy savings, diversification of energy supplies and an accelerated roll-out of renewable energy to replace fossil fuels in homes, industry and power generation.

The green transformation will strengthen economic growth, security and climate action for Europe and our partners. The Recovery and Resilience Facility (RRF) is at the heart of the REPowerEU Plan, supporting coordinated planning and financing of cross-border and national infrastructure as well as energy projects and reforms.