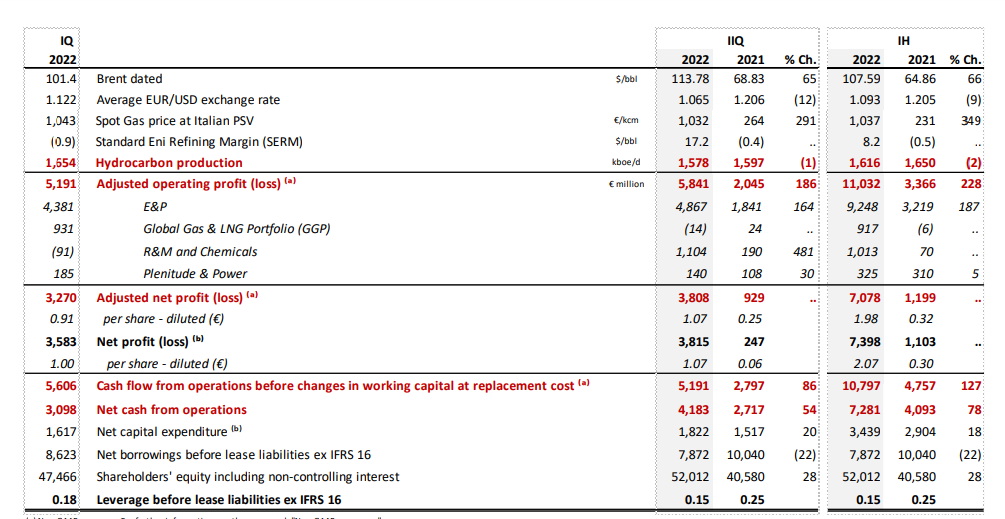

Italian energy group Eni reported a jump in profits in the second quarter of 2022 on the back of soaring oil prices. Adjusted net profit in the period came in at 3.8 billion euros (€7.08 billion in Q1 2022), up from 0.93 billion euros in the same period last year.

Adjusted EBIT in Q2 2022 was €5.84 billion, up 13% q-o-q and more than doubling y-o-y, driven by the favorable commodity price environment, strong refining margins and the focus on cost management and business operating performance.

In a buy-back program based on the authorization granted by the Shareholders Meeting on May 11, 2022, the Board of Directors approved a new share purchase program to be executed through April 2023, providing for a minimum outlay of €1.1 billion and a possible upside up to €2.5 billion, depending on trends in the scenario, the company said.

In the second quarter 2022, the group’s adjusted cash flow before working capital at replacement cost was €5.19 billion. In the first half of 2022, it reached €10.80 billion, more than doubling y-o-y.

Key operating and financial results Source: Eni

Looking ahead, adjusted cash flow before working capital at replacement cost is expected to be €20 billion at 105 $/bbl, versus their previous guidance of €16 billion at 90 $/bbl.

Organic capex is seen at €8.3 billion, in line with previous guidance of €7.7 billion, adjusting for EUR/USD exchange rate updated assumption.

Commenting on the results, Claudio Descalzi, Eni CEO, said, “Amid uncertainty and volatility in markets, we moved fast to secure new energy supplies. After new gas agreements with our partners in Algeria, Congo and Egypt earlier in the year, in June Eni entered the North Field East venture in Qatar, part of the world’s largest LNG project. In East Africa, gas production started from the Eni’s operated Coral South FLNG, the first development of Mozambique’s large potential. In Italy, we have invested to rebuild gas storage ahead of winter and our refineries raised their processing rates significantly to ensure oil products are available for the market.”