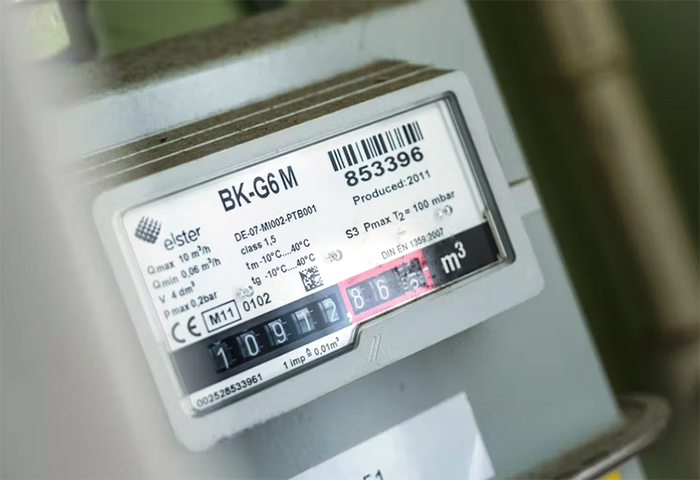

At a time when Europe is struggling with high electricity bills as a result of reduced energy supplies from Russia, the market for smart electricity meters is set for robust growth, with a total of 106 million smart electricity meters forecasted to be deployed across the region during 2022–2027, according to the latest study of the European smart metering market. More than 56% of the electricity customers in EU27+3 had a smart meter by the end of 2022. The study has closely tracked the development of the market since the research company’s inception in 2004. At the end of 2021, the EU27+3 region was home to nearly 163 million smart electricity meters, corresponding to a penetration rate of 53%. Growing at a robust CAGR of 5.8%, the installed base of smart electricity meters is expected to reach a penetration rate of 74% by 2027, driven by large rollouts in the UK, Poland and eventually also Germany and Greece, in combination with nationwide rollouts in several small- and mid-sized countries. The European smart gas metering market will meanwhile increase its installed base of devices, from 46 million units in 2021 to 76 million units in 2027.

The composition of annual smart electricity shipment volumes is expected to change significantly over the coming years, as rollouts in many markets in Western and Northern Europe are now either well-advanced or largely completed. An ongoing trend that is spreading across Europe is the deployment of second-generation smart meters in countries such as Italy, the Nordics, Spain and the Netherlands. Also read: How Many More Billions Will Europe Have to Throw In to Combat Energy Crisis?

In terms of first-generation projects, the 10 fastest growing market during 2022–2027 will meanwhile all be in Central Eastern and Southeastern Europe – a trend that confirms that focus is shifting away from Western European markets that historically have been the center of attention of the European smart metering market throughout the past decade.

Another ongoing trend, the study notes, is the change related to communications technologies being used for data exchange with the utility back office. The study estimates that standalone wireless connectivity options such as 3GPP-based LPWA will grow their annual share of smart electricity meter shipment volumes from 33% in 2021 to 57% in 2027. Annual European shipments of NB-IoT and LTE-M smart electricity meters are forecast to grow at a CAGR of 18.0% during 2021–2027, from 1.4 million units in 2021 to 3.7 million in 2027, the study notes.

Also read: e& enterprise Supports Etihad Water and Electricity’s Smart Projects